On March 13, the Joint Economic Committee Congress of the United States met to discuss the country’s economic growth. The report covers how the last part of 2017 and the first few months of 2018 have gone. The hefty details of this meeting highlighted discussions the committee had where they analyzed the gradual increase of America’s weak economy, the new Tax Reform, America’s infrastructure, and their views on the current state of education. There was an chapter of this report dedicated to a particular new subject and stood out from any other mentioned. This chapter featured the committee analyzing a new subject that boomed during the last half of 2017: Cryptocurrency and blockchain.

This discussion took place during the 9th chapter of the Joint Economic report, which you can read for yourself here.

The first few pages of chapter have the committee taking a bold step forward and quickly acknowledging the strength of blockchains. The introduction of this section not only praises a blockchain network on its nearly invulnerable security, but how consumers can have seamless transactions from a reliable network. This report underlined how 2017 was the year for cryptocurrencies and they couldn’t have been more correct.

Before we get into the actual report, for those who don’t know, what is the Joint Economic Committee? What do they do and what is their purpose? A good question to answer prior to diving into the report.

Congress created the Economic Committee in 1946 when it passed the Employment Act. This act was their way of attempting to ensure another Great Depression did not occur. The committee serves to review the current economic conditions of the United States, analysis those developments, and recommend courses of action our country can take by recommending policies that build on the successes and failures of our present economic status.

The Economic Committee release an annual report where they provide an analysis of the previous year and what they foresee for the future in a detailed report where they offer policy recommendations for how the United States Congress should handle their findings.

Summary of the Joint Economic Report

For those who don’t want to spend half an hour reading the hefty portion in the report where the committee discuss cryptocurrency and blockchain, this section highlights bold points from the overall discussion. An entire summary of the report will not be covered.

They Define Cryptocurrency

For those who don’t want to spend half an hour reading the hefty portion in the report where the committee discuss cryptocurrency and blockchain, this section highlights the discussion’s bold points.

The first few paragraphs of the report detail how the committee does not specialize in understanding this technology. This is expected as 2017 really highlighted the importance of the technology to the general public. They back this up by bringing up how during the end of 2017 the Google search results for words such as “What is Bitcoin?”, “Blockchain”, and “Ethereum” hit an all-time high. Everyone was scrambling to figure out what was going on and what they were missing out on.

Market Share

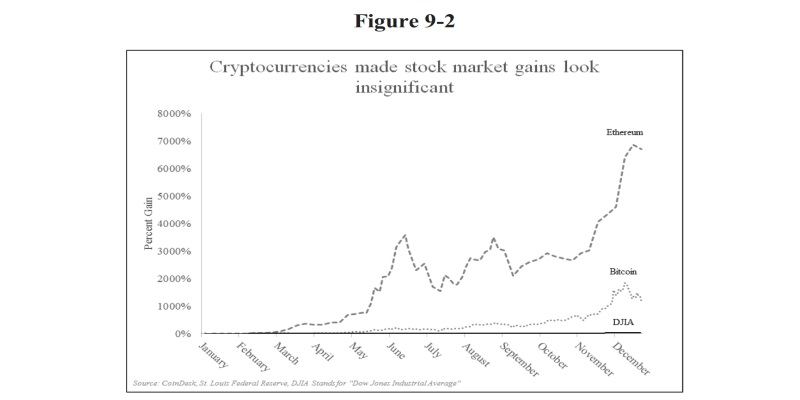

And they have good reason to feel they need to learn more. While the Dow Jones Industrial Average (DJIA) saw a 24 percent increase to reach 24,719 points and the S&P 500 grew by 17 percent, the cryptocurrency markets were far ahead of both.

The largest flag showing the importance of cryptocurrencies was Bitcoin’s jump. The currency started 2017 at around $1,000, already making it a strong contender. By the end of the year the total had boosted forward to over $12,500; a 1,100 increase in value, and it almost reached $20,000 during its highest reign.

Overall, the total price of all cryptocurrencies on the market at the end of 2017 came out to $216 billion. These numbers show cryptocurrency markets were certainly not a brief fad that would fade away in the background. The market gradually continues to grow and the economic committee praise its health.

Can Cryptocurrency Compare to Fiat Currency?

A portion of this report attempts to address a question many newcomers to cryptocurrencies want answered: Can these digital currencies compete and work as an actual currency?

During this excerpt the committee point out several obvious flaws of cryptocurrencies, such as the volatile market, hefty transaction fees, and slow processing time of transactions. For veterans of cryptocurrency, these comments should come as no surprise and cement the fact larger digital currencies, such as Bitcoin, need to improve on these fronts.

These critics towards cryptocurrency should not get viewed as decisive blows. Instead, they stand as large challenges the developers need to think about as they move forward. Should digital currencies want to find acceptance with the public, the market needs to find a level of reliability a physical currency comes with.

A Blockchain Behind Every Good Cryptocurrency

The first dozen pages of this report focused on showing what all the headlines were talking about, such as emerging cryptocurrencies and Bitcoin turning into a giant on the market. But the real technology they were interested in exploring was what goes on behind the digital currency: the blockchain.

The economic committee see the potential of keeping the blockchain technology contained on the cryptocurrency market. While the technology emerged with digital currency, they know it can easily expand out to other industries to benefit those already created structures in many ways.

One example highlighted during this portion brings tasks a blockchain network to keeping tracking of a person’s private medical records. Not only would the blockchain hold a ledger of all this information, the patient could access their records whenever they chose to and share that information with their doctors. By granting patients the ability to access their medical records digitally they have the freedom to move around the world and always have this information on them for those who need to access it in periods of crisis.

The committee designs another example focused more on working at a large industry, such as a power station. When the station creates electricity, the information gets recorded on a blockchain and makes it available to utilities for them to purchase. When a utility makes a purchase, the transaction gets documented on the blockchain and when the transfer happens the electricity goes out to the buildings of connected to the utility.

While the electricity example already takes place everyday, the committee points out this digital ledger would quicken the entire process and cut down on costs already established. Both examples improve a system already in place and provide an easier lifestyle for everyone involved.

What Does Congress Take From This?

The economic committee had two goals for the first two thirds of this report: ensuring congress acknowledged the legitimacy of cryptocurrency and show how blockchain expands beyond cryptocurrencies. The committee want to shine a new light on this technology and broaden the gaze of anyone who still feels weary about it.

The last seven pages focuses on how congress should approach attempting to regulate these technologies, especially since many get involved with it in the first place as they see it as way towards financial freedom and not getting stuck having to go through industries. They break this down into four sections:

- Securities Regulation

- Taxation

- Money Transmission

- Future Regulatory Questions

Securities Regulation

The part about Securities Regulation features a specific example: when Ethereum launched their Decentralized Autonomous Organization (DAO).

The concept behind the DAO was users could place their ether into a pool of money and then vote on what project the development team should use the currency on. The more currency a user placed into the pool, the bigger vote they had. A hacker discovered this a fault in the code exploited it. They were able to make off with over $50 million in ether. This infiltration forced the DAO to dissolve and all of the currency found its way back to the original owners.

The economic committee reflect the development team behind the DAO should have come forward to the Securities and Exchange Commission (SEC). If it had, things may have ended differently or at least granted those who invested in the project additional security.

How to prevent something like this in the future? The committee highlight how community teams have already moved forward with this initiative and have brought it forth to SEC Chairman Clayton, calling it Simple Agreement for Future Tokens (SAFT). SAFT broke down how a presold token was classified as a security. When the project goes live and becomes available to the public, it no longer gets classified as a security.

Clayton has yet to respond. However, what he does next could determine how community members work with members of congress.

Taxation

Now, we’re getting into the thick of it and becomes a little tricky for those who never took economic classes.

Though, taking a step back to 2014, the IRS wanted the same answers to questions we’re still asking today. The IRS brought their findings forward and announced they were going to treat a virtual currency as if it were a foreign property and receive a similar tax process.

What sort of tax were they hoping to clarify? For example, a person could purchase a piece of foreign property and hold onto it until the location gained value. When it did, they would sell it and turn the profits into dollars. The profit gained from the final transaction is subjected to taxation. When a person stores their dollars in a savings account and it gains value, this amount does not get taxed. The end result settled on choosing t have cryptocurrency investors file their profits under an income and capital gains tax.

Though, both the economic committee and the IRS still have progress to make on how to properly tax it. The committee believes this needs to happen sooner rather than later. Because if it happens later investors may find stricter rules going into place. This could freeze potential investments from going to newer currencies and limit the market.

However, one bill currently going through due process hopes to make it easier. The bill, called the Cryptocurrency Tax Fairness Act of 2017, doesn’t require consumers to tax virtual currency transactions under $600. Presently, the bill remains with Congress as they decide what to do with it. The Cryptocurrency Tax Fairness Act of 2017 could go through several drafts before they finally approve it.

Money Transmission

The drive behind cryptocurrency was for people to digitally handle their money without a medium agency. Though, certain laws need to happen to provide additional security for someone who lose their funds. Certain laws could help make this happen, but this typically happens statewide. When a cryptocurrency launches, anyone around the world can freely use it and trade to anyone they wish.

This presents a baffling choice for congress on what they need to do. Any bill moving forward that attempts to address this could easily take several years to go through all the proper channels. For now, this area of policy remains up in the air. The economic committee believes lawmakers may move forward and present similar solutions to the structure created by the European Union passport regime. This program grants businesses the opportunity to make transactions outside of their own country. Both parties must settle within the European Economic Area (EEA) for a transaction to go through. Traditionally, the business requires authorization to make a transaction with another person from a different country. But if the country was within the EEA, none of the parties involved need additional approval.

This concept could serve as a good starting point and could certainly see some improvement.

Future Regulatory Questions

The last of the four questions shows how much the economic committee still does not know about this technology.

When Congress moves to create these laws the committee encourages them to work with the cryptocurrency community. Both sides of the aisle need to come forward with a balance approach and accept one another. Those who use cryptocurrency seek a way to operate with a varied freedom they normally wouldn’t receive with a bank and if congress attempts to pressure this, they may see backlash.

The blockchain technology can potentially go everywhere, and the economic committee acknowledge it. They acknowledge the strength of cryptocurrency. But they also acknowledge the obvious flaws in the digital currency. If both sides meet each other in the middle, this can only benefit all cryptocurrency developers and investors. Congress needs to initiate fair regulations to not dampen the eagerness of this community. Though, this report shows positive breakthroughs.