Augur has languished at relatively low values since its release but with excellent tech and a talented development team could this undersold coin turn out to be the best investment of 2018?

There is wisdom in the crowd, or rather there is wisdom in sourcing your predictions from crowds. For a long time businesses and surveys have attempted to harness the perceived wisdom of the crowd to help them create better policies and plans and to attempt to predict the future of the market.

The problem is that it has always been difficult to build a diverse enough focus group in order to make crowdsourcing a viable option. This leads to many surveys and polls being undertaken by experts who can inadvertently weight their polling towards a single demographic. If all of your voters come from a single group it is unlikely that your results will be accurate and this can create highly misleading polls. Just look at the polls leading up to Brexit in the UK, they were disastrously wrong.

The team behind Augur believe that they can harness the wisdom of the crowd through blockchain technology in order to solve this problem and provide better predictions.

Augur Wants To Use The Blockchain To Make Crowd Prediction Viable

The wisdom of crowds differs significantly from crowd psychology, or mob mentality. The idea, posed in 2004 by James Surowiecki, argues that by aggregating the decisions of large numbers of individuals it is possible for the “crowd” to come up with a better decision than any single individual would be able to. This idea, that the decisions of large numbers of individuals are better than the decisions of single individuals lays the basis for Augur.

Augur was one of the first Ethereum Dapps and was launched following a wildly successful ICO in 2016. The premise is simple, allow users to make a bet on the outcome of a future event, use those bets to define the probability of a certain outcome and then reward those that chose correctly. Augur’s team hope that this simple idea could be enough to revolutionize multiple industries.

Augur have set up their system to work like a giant information stock exchange. Users are able to buy and sell “shares” for certain outcomes and their reward is based on the probability of the outcome. Each share costs $1 and the price you pay indicates the probability of that outcome, for example a prediction share costing 65 cents would have a 65% chance of occurring, according to the Augur markets. If a user chooses the correct outcome they will be given back $1 for every correct share they bought. This incentives users to buy shares at a low value before the outcome is certain in order to obtain the maximum profit. The share price can be used by analysts to attempt to predict the outcome of certain events.

The most important aspect of Augur is its tradable token; REPutation, or REP. These tokens are used to set up the “prediction markets”. Augur “markets” or questions are set up by users who put up some initial capital to create the market. They are then rewarded with half of all trading fees on the network. This incentives REP holders to create new markets.

REP is also used to incentivize another important aspect of their platform, the reporters. These reporters form a decentralized network to confirm the outcome of real world events. Reporters stake their REP on an outcome, for example that Donald Trump was elected president, and are then either rewarded or punished based upon whether the reporter consensus agrees with them. Honest reporters, those who told the truth, are given a reward in REP and dishonest reporters receive nothing. It is important to note that REP is only needed for users who want to create a market or report, it is not necessary for ordinary users who just wish to buy shares.

Augur sounds a little bit like a decentralized bookie and to a degree it is. Users are essentially betting on what they believe will be the most likely outcome to a specific question.That being said Augur believe that their system has utility outside of gambling. They hope that Augur could be used to set up cheap derivatives markets that could help to breakdown many of the international barriers to financial trading. One example could be Chinese traders gaining access to the American stock market.

Augur’s main strengths are its low fees and decentralization. This allows it to ensure that any results cannot be manipulated by a single reporter and that all outcomes on the market are more “honest”. It also allows Augur to protect the privacy of its users and it gives Augur a little more leeway concerning state gambling and finance laws, although this may soon change as it seems that legislation regarding ICOs and cryptocurrencies are quickly gaining pace.

Is REP a Good Investment?

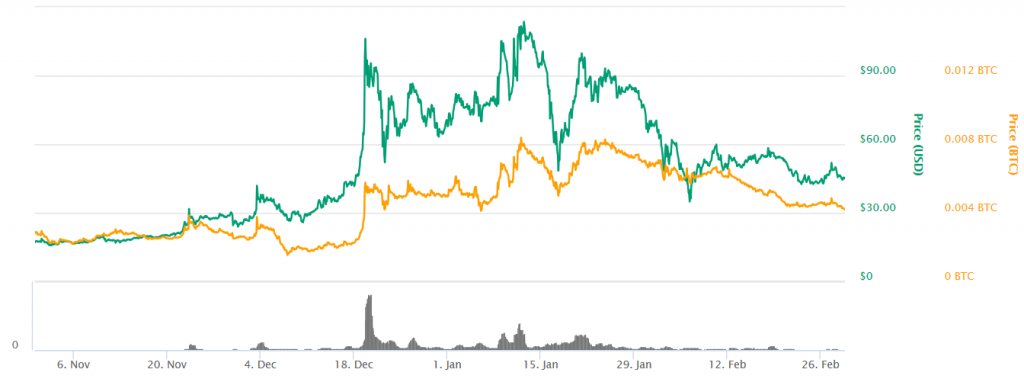

Augur is one of a select group of cryptocurrencies that despite immense promise has failed to perhaps meet its market potential. Like most cryptocurrencies Augur experienced a significant rise in December amid the crypto gold rush before crashing back down again in early January as air was let out of the bitcoin bubble. In recent weeks Augur seems to have settled at around $45.

Compared to where REP was a year ago it has experienced an impressive gain of over 350% but in cryptocurrency terms and in terms of Augur’s potential value this still leaves the cryptocurrency looking fairly undersold.

The best way to determine the value of any cryptocurrency is to look at two things; the technology that powers it and its potential market reach. In terms of technology Augur is highly promising. It combine a risk reward system that encourages honest reporters and allows market makers to set up simple predictions markets or complex derivatives markets at a relatively low cost. They also allow non-technical users to instantly access a highly advanced marketplace using fiat currency. Currently they only offer their platform in beta but they plan to slowly roll out the full platform over the course of the next few years.

The main problem with the technology lies in the strength of crowdsourcing as a prediction tool. While crowds have proven to be quite successful at predicting fairly simple yes/no outcomes they have trouble predicting more complex outcomes. Recent studies have also shown that crowd wisdom may lack the logical discussion or debate required to be truly effective. Researchers found that by breaking up crowds into smaller groups and allowing them to discuss the issue first the results were up to 49% more accurate than traditionally crowdsourcing.

As promising as the tech is Augur’s great strength is their market reach. For starters they have access to the highly lucrative sports betting market. In the United States alone the “illegal” sports betting market (run by overseas book-keepers) is pegged to be worth over $3 billion and legalized sports betting could be worth over $6 billion. On top of the profitable betting market Augur will also be able to diversify into the lucrative derivatives trading industry, assuming that they are not barred from doing so by upcoming regulations.

“Panel: Do Decentralized Insurance and Prediction Markets Go Together?” by @etherisc https://t.co/EieYIEizIZ @augurproject @gnosispm panel from Devcon, Cancun…

— Ron Bernstein (@RonB7139) February 24, 2018

It is likely that Augur will see significant price increases as they follow their roadmap and roll out more advanced forms of predictions and other uses for the Augur platform. They will benefit from renewed media attention and an increasingly large user base as they draw in people typically excluded from trading on traditional markets.

In terms of risks, Augur is particularly open to stricter gambling and securities trading regulation being applied to ICOs. This represents a significant problem for Augur and tighter regulations could lead to them being locked out of highly profitable markets. That being said it seems like many countries, particularly in Europe, are opting for light touch regulations. The Swiss financial regulator FINMA released guidelines breaking ICOs into a number of categories and stated that each project will be considered on a case by case basis. Despite some countries taking a light touch approach regulations could still prove to be problematic for Augur. The cryptocurrency was hoping to benefit from their regulatory flexibility by gaining access markets that more traditional providers had been locked out of thanks to strict regulations.

It should also be remembered that REP is subject to the same volatile market conditions as other cryptocurrencies. This means that its fortunes are tied closely with those of Bitcoin and other larger tokens. If there is another major market crash or boom then REP will quickly follow suit. You should also not expect every rise to gain real traction and remember that the cryptocurrency market is very susceptible to “pump and dump” schemes, especially lower value, lower market cap, tokens like REP.

The opportunities for REP to grow in 2018 are huge. If Augur are able to capitalize on their broad market reach and continue to build their platform then it is likely that we will see an increase in the value of REP. That being said, whether they are able to navigate the choppy regulatory waters ahead remains to be seen.

REP would make a good part of a balanced portfolio but still represent a high risk, high reward investment, even by cryptocurrency standards.

This does not constitute investment advise, please do your own due diligence, remember that cryptocurrencies are highly volatile assets and that your capital is at risk