Privacy coins are one of the most important aspects of the cryptocurrency market. In 2017 Verge, Monero and others all saw impressive gains. The field is very competitive and for the moment Monero is generally considered the privacy coin King, could PIVX be the top contender for Monero’s throne?

Privacy is big business, in the wake of Snowden’s revelations concerns surrounding government and corporate surveillance have become increasingly common. In absence of government action to protect their privacy many users took matters into their own hands and began to use TOR, VPNs and other tools in order to protect themselves. Blockchain technology has proven to be an excellent way to protect the financial privacy of users and coins focused on protecting their users anonymity have become increasingly popular.

The most well-known privacy coin is Monero and this has set the standard for a longtime. Despite its popularity Monero has had a history of unsavory connections with the underworld and its effective privacy controls have sadly made it the token of choice for criminals. Unauthorized browser plugins have also been attacking ordinary users in an attempt to mine more XMR. To make matters worse it looks as though Monero will be entering a period of instability as the MoneroV hard fork raises questions about the security of the Monero blockchain.

The uncertainty surrounding Monero leaves a gap for a new privacy coin to break through, is it possible that PIVX could be that coin?

What is PIVX?

PIVvX or Private instant verified Transaction, is a privacy focused token forked from DASH in Janurary 2016. PIVX’s goal is to build a real digital currency that is easy to spend but still has the necessary tools to help protect the privacy of its users. To achieve this the PIVX team focuses on minimizing transaction times and fees while maintaining privacy and security.

PIVX is interesting because it is one of the early adopters of the proof-of-stake consensus system. At the moment the vast majority of cryptocurrencies still use Proof-of-work, whereby miners use computer power to solve complex equations in order to process transactions. Proof-of-stake simply requires users to “stake” a portion of their cryptocurrency in order to receive rewards and ensure the integrity of the network. This is the same method used by NEO. Proof-of-stake has seen a rise in popularity as it requires significantly less resources to process transactions and prevents large mining pools from dominating the blockchain.

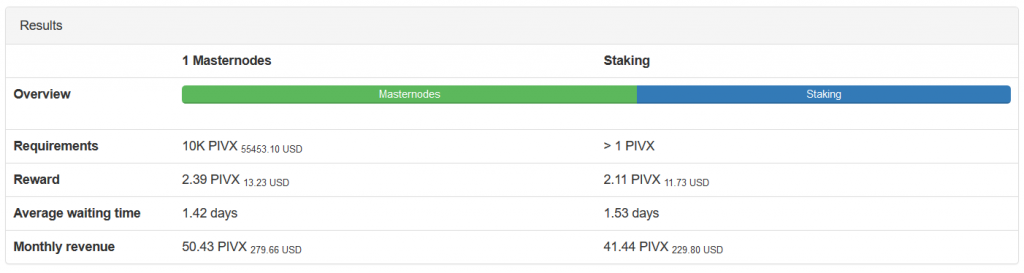

Like its parent cryptocurrency DASH, PIVX makes user of a two-tiered consensus system. The top tier are masternodes. These require a holding of 10,000 PIVX in the PIVX-Qt wallet that can’t be touched. These masternodes are used to verify and anonymize transactions, vote on community proposals, and pay out dividends in the form of PIVX rewards. As with DASH the masternodes form the basis of many PIVX features and allow the cryptocurrency to have a built-in governance system.

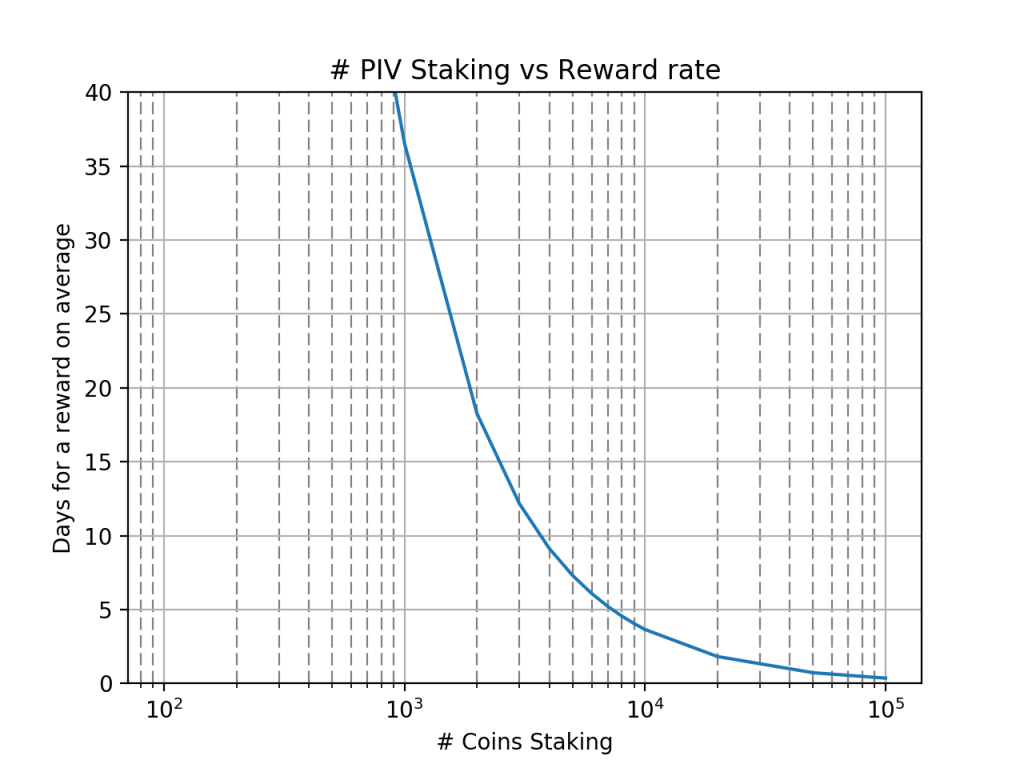

The second tier is powered by proof-of-stake. Every single user is able to stake their coins in order to secure the network and receive rewards. This means that all users who commit to keeping their coins on the blockchain will be able to receive a reward. Every 60 seconds 5 PIVX is minted, 10% of this goes to a development pool and the remainder is split between Masternodes and Stakers using the “seesaw Algorithm”. This constantly adjusts the amount of rewards that go to each party based on the number of Stakers and Masternodes at any given time, the algorithm slightly favors Masternodes to cover their higher operating costs.

The most important part of PIVX is the ability to privately send coins without being traced. Many users are concerned about the low levels of privacy offering by Bitcoin and other cryptocurrencies. Theoretically individual Bitcoins can be traced to specific wallets, some of which may have less than savory associations. This could theoretically undermine the value of those coins.

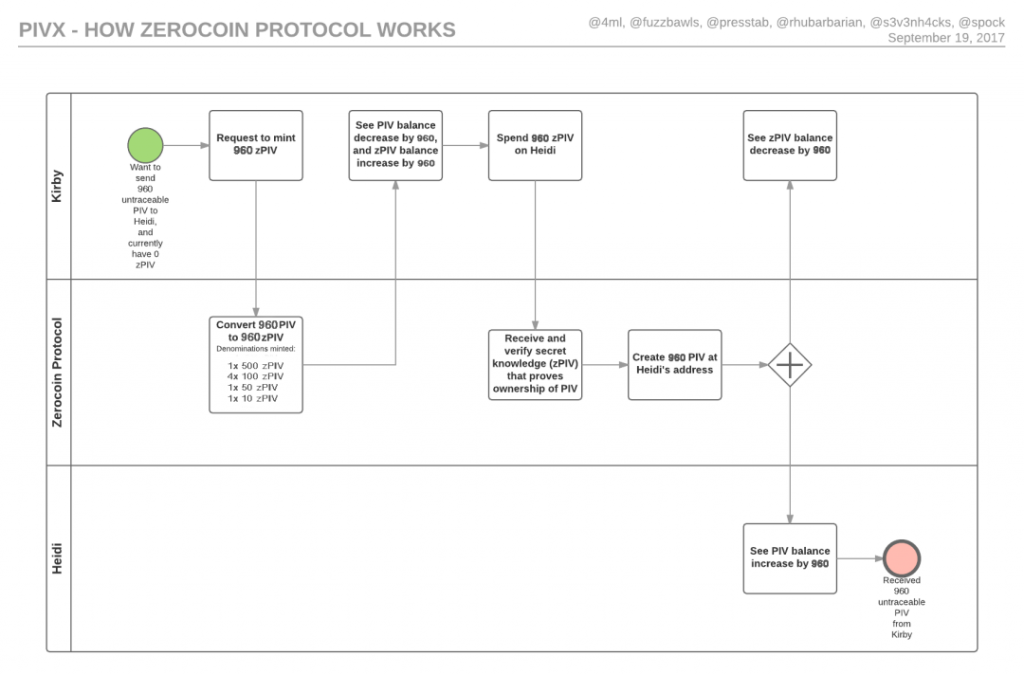

PIVX solves this problem using the Zerocoin Protocol (ZPIV). This uses a coin mixing service with zero knowledge proofs to sever the link between the sender and receiver with theoretically no way to trace the origin of the transaction. ZPIV accumulators are encrypted using RSA-248 challenge generated keys which negates the need for a trusted setup.

In order to provide this level of privacy PIVX uses a process called “minting”. This turns PIVX coins into untraceable ZPIV coins. When a user wants to send PIVX coins they first convert these into a number of different donations of ZPIV. These coins are then verified and sent to the receiving wallet, where they are then converted back into PIV. The blockchain tracks the wallet balance of both PIVX and ZPIV to prevent double spending. PIVX wallets are also capable of automatically minting 10% of available PIVX coins in order to automatically provide a pool of ZPIV coins that can be spent.

Another interesting feature of PIVX is SwiftTX, or swift transactions. These are near instant transactions that are made possible thanks to the network of masternodes. PIVX uses this network of masternodes to make instant spending and receiving possible with transaction fees that can be fractions of a cent. This is designed to make PIVX practical for everyday use.

In the future PIVX plans to move “community designed governance system” that will include the entire PIVX community, rather than just masternode holders. Currently only masternodes can vote on proposals on the PIVX network. The final form of governance will cover three different kinds of proposals

- Manifesto Governance proposals will very rarely happen and will require a high level of participation during the voting process. The aim is to make sure that even people who don’t normally involve themselves with the voting process will be aware that a Manifesto Proposal has been submitted. These kind of proposals will change the entire direction of the PIVX ecosystem

- Treasury Governance proposals already exist and for allocating funds in the monthly treasury budget, these would include advertising costs, general overheads and future development costs. These proposals ensure that the entire community has a say in how the PIVX blockchain is funded

- Protocol Governance Proposals have no costs and are to make decisions regarding the code base, or the priority of, changes to the PIVX system. These proposals are then subject to a Treasury Governance proposal once approved. The core developers can veto a Protocol Governance proposal if it is technically impossible. These kind of proposals will help to prevent a contentious hard fork in the future.

Is PIVX a Good Investment?

Privacy coins are generally considered to be one of the best long term investments in cryptocurrency at the moment. Verge has been able to offer its earliest investors a staggering return of almost 800,000% since trading began. For a long time privacy coins have been considered one of the best hedges against potential regulation in the cryptocurrency market and as Governments begin to tighten their grip over Bitcoin and other tokens it is likely that PIVX, Monero and Verge will begin to see their value skyrocket.

I am inundated by people asking me for recommendations on cryptocurrencies. If you would use your heads you would figure out that the privacy coins (anonymous transactions) will have the greatest future. Coins like Monero (XMR), Verge (XVG), or Zcash (ZEC) cannot lose.

— John McAfee (@officialmcafee) December 13, 2017

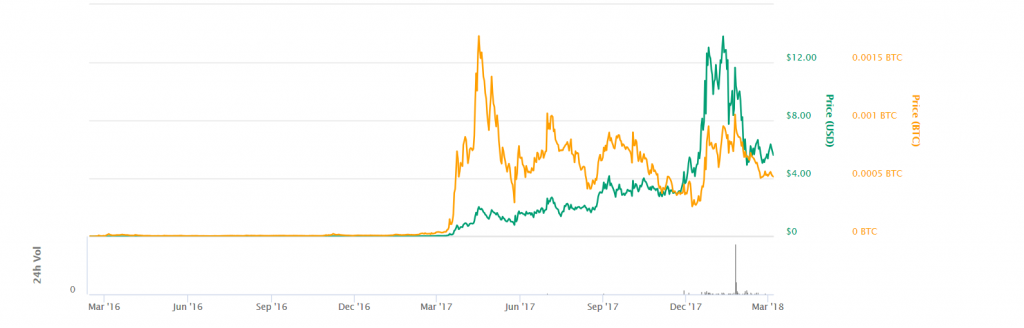

Since PIVX’s inception in 2016 the coin has gone from being worth less than a single cent to being worth around $5 per token, with a high of $13 in December 2017 as it was caught up in the cryptocurrency boom. Any jumps in value have largely been driven by media attention on PIVX and cryptocurrency in general.

Despite its potential PIVX has struggled to gain mainstream attention and for the moment languishes towards the bottom half of the top 100 cryptocurrencies by market cap. This is a double edged sword for investors. On the one hand it means that PIVX has kept a relatively low value which will make it easier for the cryptocurrency to break out and experience major gains. On the other hand it means that PIVX has relatively low liquidity and may not be as easy to acquire as some of the more popular cryptocurrencies.

The fact that PIVX utilizes a proof-of-stake consensus method makes it attractive as a long-term hold. Not only will investors be able to benefit from future price increases but they will also be able to receive dividends on their investment by “staking” existing assets. Investors who want to purchase a large amount of PIVX will be able to further benefit by buying an excess of 10,000 PIVX ($50,000) which should give them a better return on their investment than simply staking lower values of coins. According to the PIVX rewards calculator a stake of 10,000 PIVX or one masternode, would return a reward of approximately 50.76 PIVX a month or $279.66 USD.

PIVX’s focus on privacy will also likely work in its favor over the course of 2018. As more states attempt to legislate cryptocurrency privacy conscious users will seek to shift their assets towards coins like Monero and PIVX. PIVX is also a good natural hedge against Bitcoin and should be able to weather any major downturn in the market.

The focus on providing a robust ecosystem and easy to use privacy gives PIVX a lot of potential for growth, the coin is likely undervalued as is and will only become more so as new features are added. It will likely be sometime before PIVX is within reach of Monero, let alone Bitcoin, but it is an excellent longterm hold thanks to its proof-of-stake consensus system and the ability to vote on the future of the blockchain.