A key part of the blockchain and cryptocurrency industries are the exchanges. Without the exchanges, people would be unable to trade, purchase or sell the various coins and tokens out there. However, with so many different exchanges out there (each that have different support for different currencies), it can get quite confusing and challenging to navigate the space. However, Loopring is trying to be the solution to that problem.

What is Loopring?

Loopring is a decentralized exchange protocol built on Ethereum, and it will allow users to trade assets across different exchanges. Basically, Loopring will take all orders sent to their network and pool them together, and fulfill the orders through multiple different exchanges. Whether an exchange is centralized, or decentralized, it will be able to use Loopring to gain cross blockchain access and to give investors the best price and liquidity possible.

So while it isn’t a decentralized exchange, it facilitates exchanging through order matching and ring-sharing, which we will speak more about later. Now that you have a little bit of introductory information, let’s take a closer look at how it works.

How Does Loopring Work?

To use Loopring, users never ever need to deposit any funds into an exchange in order to start trading. With Loopring, the funds always remain in our wallets. This gives you full control over your funds throughout the process, which lets you edit your order quickly and easily as well.

When you are ready to make a trade through Loopring, you need to submit an order through the loopring.io wallet. The order would then be sent to a series of off-chain nodes, as well as some smart contracts. These ensure that the coins in your wallet are accurately and successfully exchanged for the coins or tokens you are trading for.

The “engine” that makes this ecosystem work are called ring miners. These miners make sure that all orders are filled. They are compensated for their mining work in one of two ways. They can either receive a fee for their work, or can take a split-margin that is based on the final purchasing amount of the order. This makes sure that miners are paid a fair and reasonable amount for finding the best exchange rates for traders, which is obviously a plus for traders as well.

An Introduction to LRC

As you could imagine, the users making the trade through Loopring will pay a small fee for the service. The fees for users (and the compensation for miners) are paid in LRC, which is the cryptocurrency coin for the Loopring ecosystem. It is currently trading at nearly half a dollar USD per LRC. The coin is instrumental to the success of the ecosystem as it is directly how the miners are rewarded for their hard work in ensuring all orders are fulfilled.

LRC itself can be purchased on a variety of different exchanges. Once purchased, you can either use the coins to open an official Loopring wallet and begin exchanging, or can simply hold the coins in your wallet and treat them like a standard investment. The choice is yours.

What are the Features of Loopring?

The main features that separates Loopring from other decentralized exchange platforms are the ideas of order rings and order sharing. An order ring is something that allows for ring-matching to take place, which is a process in which a series of trades are all pieced together to fulfill each other. This means each order can potentially help fulfill another, making the process much more efficient. Order sharing allows an order to be split into partial orders to help it become fulfilled easier.

Think of it like this. Person A wants to trade ETH for some BTC, Person B wants to trade BTC for LTC, and Person C wants to trade LTC for some ETH. Instead of each needing to be its own order, they can be combined into an order ring. If the amounts don’t exactly add up, that is where order sharing comes into play, and the remaining would simply be put into another order ring until all orders were completely filled.

In addition to all the features we have mentioned, there are also several benefits to using Loopring over traditional and centralized exchanges. Loopring is a safer way to trade as your tokens and/or coins don’t ever need to be put into an exchange, as they can remain safe in your wallet. There is also very high liquidity with Loopring as the order sharing and ring-matched orders assist a lot in that department. The trades are also completely fair and there is no reliance on a central authority, the ecosystem and platform is completely decentralized.

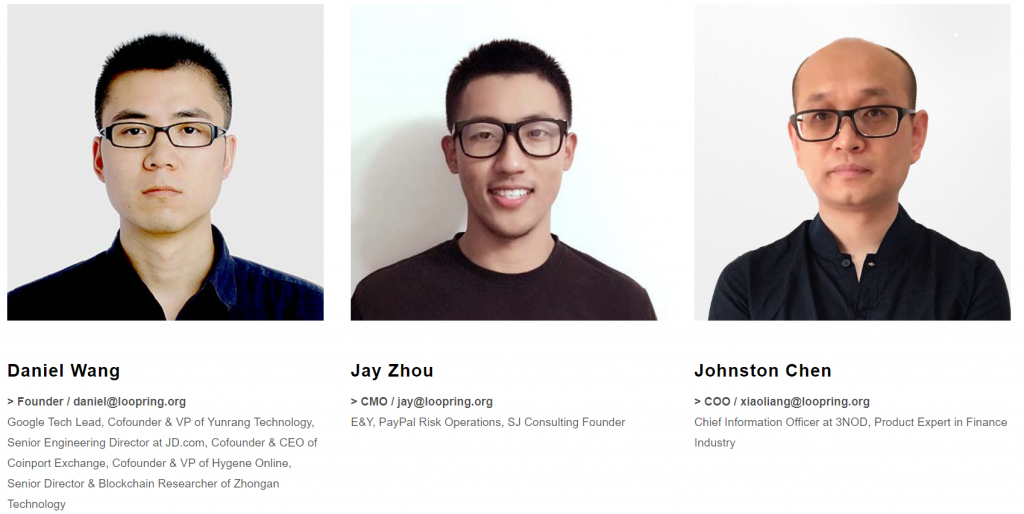

The Team at Loopring

Loopring has some lofty goals and hefty expectations for their platform, and this type of future outlook requires a strong and dedicated team. Daniel Wang, who is the founder of Loopring, is a former Google Tech Lead, who has also been a major part of several different technology companies and start-ups. The company CMO is Jay Zhou who is a former employee of E&Y, PayPal and helped to found SJ Consulting. The COO is Johnston Chen, who was CIO at 3NOD and is an expert on the finance industry.

As you can see, their leadership is made up of individuals with lots of impressive experience throughout their professional careers. The team at Loopring is rounded off by developers, software architects, researchers, advisors and more.

In conclusion, Loopring is not trying to compete with the exchanges out there in the industry today, but is trying to connect to them and work with them. It has impressive features and is incredibly flexible, which is almost necessary with the always-changing cryptocurrency and blockchain markets. 2018 promised to be a big year for Loopring’s implementation and expansion, so keep your eyes peeled for more news and information about this exciting platform.