Cryptocurrency has been embroiled in a bear market since January 2018 and things still aren’t looking up, people are generally blaming potential incoming regulations.

Regulation is considered to be one of the big incoming problems for cryptocurrency over the next few years. It all began with China’s decision to ban ICOs and since then organizations around the World have called for more stringent controls.

Despite the concerns in the cryptocurrency community regulations aren’t something to be afraid of and may actually be imperative to the market’s success in the long term. To understand the effects on the market it’s necessary to understand why governments have become concerned about Cryptocurrency.

Fraudulent ICOs, lost tax revenue and suspicion of the new have shaken Governments

While some of the more Libertarian leaning members of the Cryptocurrency community see any form of Government intervention as evil, the antithesis of Satoshi’s dream, most of us realize that there is the ideal and then there is reality. Cryptocurrency was always going to draw the ire of the establishment and it’s important for us to understand why.

Take the example of China. He Chinese authorities were the first country to declare ICOs illegal in September 2017 and is currently taking moves to completely ban all cryptocurrency trading. This was largely down to the sheer number of Chinese citizens choosing to invest in cryptocurrency.

The authorities became increasingly concerned as evidence of scams mounted and a large amount of Chinese capital became trapped in Cryptocurrency. This led them to take quick, heavy handed action. South Korea faced similar difficulties and has also attempted to follow in China’s footsteps.

China doesn’t have the strongest record on economic freedom, which explains their sledgehammer approach, however their concerns have been echoed by a number of organizations in the West. As over half of 2017’s ICOs have already failed governments and financial institutions have become increasingly concerned that a major crash could result in unsustainable amounts of money being “lost” from the economy.

The biggest concern for most Western governments comes from one of the defining features of cryptocurrency; in many cases it is difficult, if not impossible, to trace the origin of a transfer. While on paper this is very much a good thing in practice it causes a huge headache for governments. While you may not have any ill intentions there are others who could use this to avoid taxes, launder money or pay for illicit substances.

Indeed there is strong precedent for this. Monero has had a long history of being used on “dark web” exchanges for illicit substances and services and more recently it has been the currency of choice for browser injected cryptocurrency mining programs. This kind of association, however unfair, has made it difficult for cryptocurrency advocates to get a fair hearing in many governments.

Uncertainty is Creating A Bear Market

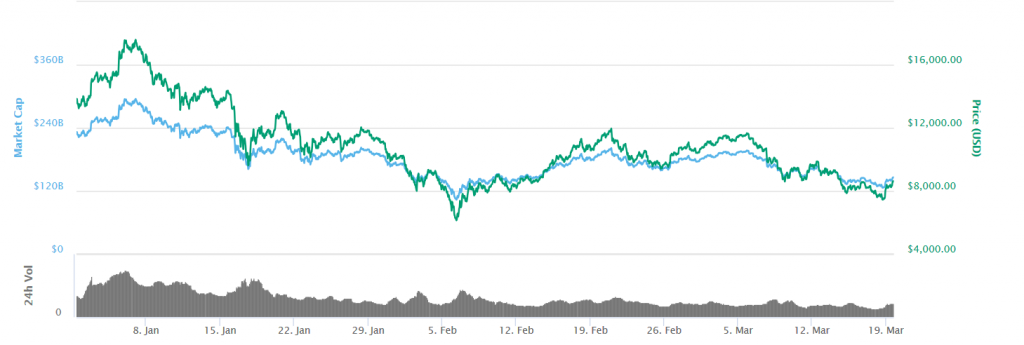

Ever since the China ban there have been rumors circulating that harsher cryptocurrency legislation may be enacted. Whether those rumors are true or not is generally irrelevant to the price of Bitcoin. Despite being fascinating cryptocurrency is still traded in a market and if there is one thing that all markets hate it’s uncertainty.

Bitcoin experienced a major crash in late January 2017 and while it has not managed to return to its previous levels it appears to have stabilized somewhere around $8,000 with little sign of rising. This shaky recovery is largely down to uncertainty surrounding whether it will still be legal to trade cryptocurrency in a years time.

The market crash also forced out many of the newer speculative investors who were interested in a quick profit. Fears surrounding increased regulations has discouraged new investors, the people who still hold Bitcoin are likely believers in the currency but any new regulatory shocks could well lead to another crash.

Global Regulation Could Prove Beneficial For Blockchain Technology

As the main problem plaguing the market is uncertainty then the solution, one way or the other, is for Governments to act and make a move. Some have already done so. Setting aside China and South Korea a number of other nations, including Switzerland and Singapore have put common sense ICO guidelines in place, essentially classifying the fundraising tool under existing financial regulations.

The main problem with existing cryptocurrency regulation is that it is too piecemeal. China can ban cryptocurrency exchanges in China but then Chinese people will simply use foreign exchanges. In recent months there has been increasingly urgent calls for an international solution to the Cryptocurrency question.

Christine Lagarde of the IMF has said that the organization has become increasingly concerned about potential money laundering and terrorist financing using Bitcoin and other cryptocurrencies. Senior ministers from France and Germany have also called for a discussion on joint action over cryptocurrency at the G20 summit.

For the moment it’s unclear exactly what that action might be but signs are not pointing towards a China style total-ban. Both the IMF and various government bodies and central banks have emphasized that blockchain technology has a great deal of potential but they want to limit the downsides.

There are two key problems as far as most governments are concerned and there are already a few potential solutions.

Initial Coin Offerings

While ICOs have proven to be an effective fundraising tool they have also proven to be a veritable breeding ground for low-quality and fraudulent projects. Regulation of ICOs will be a little tricky as many different kinds of financial instruments lack an international framework.

That being said the most likely approach is going to be similar to Switzerland. Whereby states attempt to bring ICOs under existing financial regulations in their respective jurisdictions. This will help to weed out fraudulent projects and will make it easier for states to keep tabs on how money is raised.

AML and KYC Regulations

One of the big problems with cryptocurrency is trying to figure out who actually owns what. Many exchanges have already preemptively attempted to solve this problem by demanding the identity of their users before they are allowed to purchase cryptocurrency.

There are two major problems here for both regulators and users. On the one hand the ability of cryptocurrency to provide its users with privacy is paramount. If a user knows the address of another person’s wallet it is possible to trace their entire financial history, which could have unpleasant consequences.

Some cryptocurrencies have already taken steps to circumvent the problem. For example Monero has an “Audit” feature that would allow tax authorities to glimpse a users assets without being able to identify their private wallet key.

This regulation is likely to cause the biggest headache. Many cryptocurrency users are afraid of governments taking too much control over cryptocurrency and will strongly resist such changes, perhaps even moving to privacy based coins. If governments take a heavy-handed approach they risk encouraging this kind of behavior. On the other hand if Governments take a relaxed stance there is a risk that they will be creating an easy way for their citizens to avoid paying tax.

Government’s Need To Define What Cryptocurrency Is

The first step for many governments will be defining exactly what Cryptocurrency is and how it is taxed. This is no easy task, cryptocurrency has been called everything from a currency to a commodity and with the increasing diversity in the sector some forms of token can’t really be called either.

Again here the best answer is to look at the Swiss solution. Governments may well have to consider each token on its own merit rather than creating blanket solutions and again, bring them under existing financial law.

The only country to attempt to craft extensive cryptocurrency legislation at time of writing is Russia. Despite the Russian authorities dislike of cryptocurrency they decided to draft surprisingly liberal laws covering virtual currencies. The law sought to regulate (and tax) the act of mining cryptocurrencies and is designed to make i easier for ICOs to operate and comply with existing local regulations.

That being said not everything is good news for cryptocurrency innovators. The SEC has begun to investigate businesses related to Initial Coin Offerings and there are fears that all tokens may now end up being classified as highly regulated securities. This has led to accusations that the US authorities are stifling innovation and there are fears that cryptocurrency companies may well move abroad.

What Effect Will Regulation Have On The Price Of Bitcoin?

You may have noticed a recurring trend. Governments around the World are looking to create soft touch regulations and are conspicuously avoiding heavy handed bans. There are two good reasons for this.

Firstly, as the Russian Government said when drafting their laws, overly cumbersome regulation would drive cryptocurrency underground and make it the preserve of terrorists and criminals, and thus harder to regulate in the long term.

Secondly, there is a lot of money in cryptocurrency and linked industries. Governments are afraid to lose the potential windfall of being a center of the cryptocurrency revolution. This has led to some countries, like Belarusiya, to declare cryptocurrency and cryptocurrency related activities to be tax exempt.

While it is unlikely there will be an overarching international agreement on cryptocurrency we can draw some conclusions by region based on existing financial regulations and prevailing attitudes. Countries in the European Union are likely to take a softer approach than countries like the United States, where the SEC has already been openly hostile to ICOs.

Even if regulations are fairly harsh this is still likely to have a slight positive effect on the value and stability of Bitcoin. The biggest problem for people who are trying to comply with the law is that they don’t know where they stand. As states build a framework for how to handle cryptocurrency it will be easier for people to remain in compliance and this should have a positive effect on the value of Bitcoin and other cryptocurrencies.

It is highly unlikely that we will see a China-style total ban World-wide. Instead we are likely to see a patchwork of more crypto-friendly regulation drafted, which should give cryptocurrency the stability it needs in order to prosper.