Analysis in financial markets is extremely important for millions of people. Many people rely on the analysis or forecasting of experts to help them with their finances. There are many experts in the world of finance and they have a ton of experience in market analysis. However, people are still people, and thus have a cap on their capabilities and are not perfect.

Thankfully, with the technological revolution over the last couple of years, we have started to see some financial analysis techniques that use AI or machine learning to predict how an asset or investment may perform based on a number of different factors. Even still, machine learning and AI isn’t foolproof and issues can still arise.

But now recently, a new hybrid model for the intelligent forecasting of financial and market analysis has been founded. It involves the best of both worlds as it combines human analysis with the machine learning and AI. The platform is called Cindicator.

What is Cindicator?

Cindicator is a platform that brings together both human market analysis and machine learning together for financial analytics and the management of assets. The team at Cindicator calls this the model Hybrid Intelligence, as it is a combination of artificial intelligence and the opinions and thoughts of analysts.

The ecosystem of the platform consists of tens of thousands of analysts with experience on a wide range of financial topics. These analysts will answer questions throughout the platform and machine learning helps to evaluate and weight their responses. The AI then creates the market analysis based on those factors and answers and the community can use the analysis as they choose.

Both forecasters/experts and community members use the Cindicator app, which has been live for a couple of years now. Despite that, Cindicator didn’t hold their ICO until just recently, in September of 2017. So as you can see, they are still pretty new and thus their model is primarily focused on trends and market predictions, but they are planning to expand in the future if they are successful.

How Does it Work?

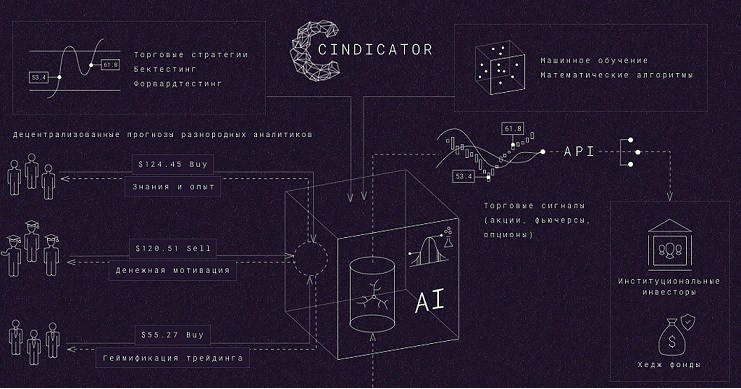

Now that you know some of the basics about Cindicator and how the platform and ecosystem work, let’s get a bit more in-depth. As mentioned, the Hybrid Intelligence model looks to use the benefits of both human analysis and machine learning. Then, the community members benefit from the analysis. So there are basically three “levels” to the structure of this platform.

The Cognitive Intelligence Platform

The first part of the structure is called the Cognitive Intelligence Platform. Basically, it is the viewpoints, thoughts and forecasts of the analysts and industry experts. There are tens of thousands of analysts and experts who participate in the community. These analysts are rewarded for their contributions to the ecosystem.

Each day, the Cindicator app sends all of the analysts a series of questions. These will differ depending on the day, and depending on your speciality (stock broker, crypto trader, etc…), the questions will be different. These could be anything from “Where do you see the Apple stock sitting at next month” or “How much will the price of Bitcoin fall or rise in the next two weeks”.

As mentioned earlier, analysts are incentivized to provide accurate and thorough responses to these questions, as they can be rewarded for them.

These questions are generally predictive in nature, and if analysts are successful or right with their predictions, they are rated higher than those who are off, and have a better chance at getting a cut of the prize from that months’ funding pool. Each month, the ratings are reset so every single analyst has a fair shot at the compensation each month.

These people are the backbone of the entire ecosystem and help the platform move forward and continue to grow and exist. And since there are so many with differing viewpoints and backgrounds, it prevents biased or unfounded forecasts.

Artificial Intelligence and Machine Learning

The second part of the structure is where the artificial intelligence and machine learning take over. After the analysts provide their predictions, they are then processed by artificial intelligence. Next, the machine learning will run its data alongside the analyst’s data in tons of models to get more precise when it comes to forecasting the markets.

To do this, the AI measures the confidence weight of each analyst. It is taken from the track record of the analyst’s past predictions and other factors. The machine learning within the platform is also constantly changing and adapting, evolving with each use.

The Community

The third and final part of the structure is the community. Once the analysts and AI/machine learning are done with the device, CND token holders can take advantage of the analysis and use it. The amount of CND tokens a person has will dictate what analytical products they can utilize and view. The more CND tokens a person has, the more complex services they will be able to gain access to. Token holders will pay a performance fee depending on the success of the analysis they use. These fees are part of the pool that gets rewarded to the analysts each month.

CND

So as you can see CND tokens are needed in order to get the most out of Cindicator. The tokens are how rewards are paid out, as well as being the way for users to gain access to the best analysis. Of course, the tokens can just be held for an investment if that is what you’re into.

Their ICO ended in September of last year and they reached their hard cap of $15 million. The majority of the tokens were distributed to token sale contributors and the team (75% went to the ICO participants and 20% went to the team) and the team will use the investment funding for development, marketing, legal and more.

The Team Behind Cindicator

The team at Cindicator is made up of a group of different individuals with experience in math, data science, trading and finance working together with one goal and a collective mind. They are always expanding the scientific community around their platform and business to work together to solve important issues.

Cindicator is led by their three founders Mike Brunsov (the CEO and co-founder), Yuri Lobynstev (the CTO and co-founder) and Artem Baranov (the COO and co-founder). Each brings their own unique and value experience to the team.

The team also features some great advisors and partners, as well as developers, traders, analysts, scientists and support staff. The team’s vision is a future with Hybrid Intelligence solving problems in the new post-capitalist era.

In conclusion, Cindicator is one of the most unique offerings in the crypto space today. Also, unlike many crypto platforms and companies, the Cindicator app and platform has been up and running for years, so you can begin using it anytime. While it hasn’t gotten a ton of exposure, it is certainly a platform (and token) to look out for going forward.